DeFi lending platforms provide a way to earn passive income. When you own cryptocurrency, you can get passive income from DeFi lending platforms. You have a lot of options to get passive income such as yield farming and staking. Instead of just holding, a person can generate profits in exchange for participation in DeFi lending platforms.

What is DeFi Lending?

DeFi lending is a decentralized finance service that allows people to lend funds without intermediaries. It is similar to traditional lending services offered by banks but is offered by peer-to-peer decentralized applications.DeFi lending platforms help people borrow and lend funds which allows crypto holders to earn passive income.

What are the benefits of DeFi Lending Platforms?

- DeFi Apps allows users to transfer capital around the world.

- It provides a high level of security to users as it is based on cryptography.

- It provides the superior speed of blockchain technology resulting in faster and speedy transactions.

- Users have more control over their finances. They can monitor their portfolio.

- It can be used to create new assets and financial tools, which makes it flexible.

What is Yield Farming?

Yield farming is the way to lock crypto assets to DeFi platforms to earn rewards. Through this, you can grow your crypto assets. The concept is similar to traditional banking practices. Banks will distribute the customer’s funds to borrowers, the borrowers will be charged interest, part of which will be used as a reward to the customers who lend their funds.

As a liquidity provider investor must lock the assets into a liquidity pool. Later, the assets will be used for lending purposes to other users. In return, liquidity providers earn interest.

What is Staking?

Staking is similar to time deposits, where the assets owned by the investors are locked for a certain period and investors will get interest from the locked assets.

Staking is a way to contribute to the security and efficiency of the blockchain projects you. By Staking you strengthen the ability of blockchain.

DeFi lending platforms for Yield farming and Staking

- Aave

AAVE allows users to securely lend and borrow cryptocurrency. AAVE users have complete control over their funds as a smart contract governs the transfer of funds between lender and borrower. Lenders can earn passive income by providing liquidity to the market and borrowers can obtain loans.

AAVE was built on Ethereum network and used Ethereum blockchain to process transactions. They are known as ERC20 tokens.AAVE protocol uses a decentralized autonomous organization (DAO) as it is operated by the people who hold AAVE tokens.

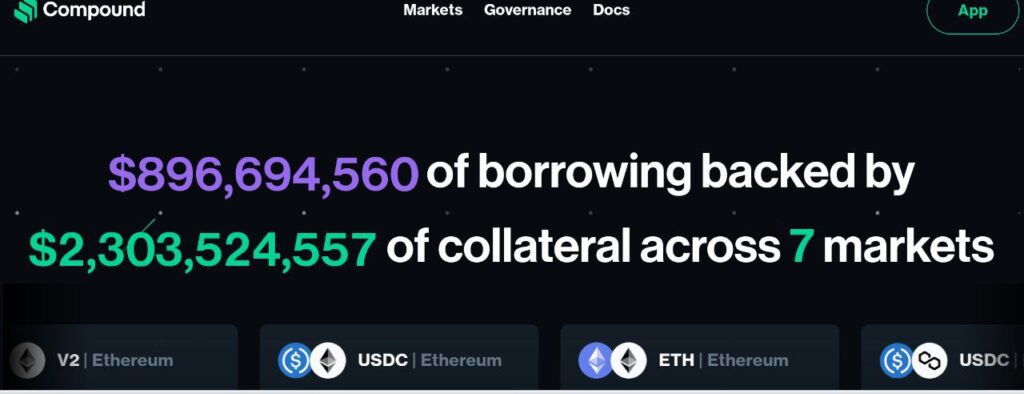

- Compound

Compound is an Ethereum-based market protocol that allows holders of crypto to lend and borrow funds in exchange for collateral. Lenders can send their tokens to generate interest. Borrowers are permitted to borrow cryptocurrencies supported by Compound.

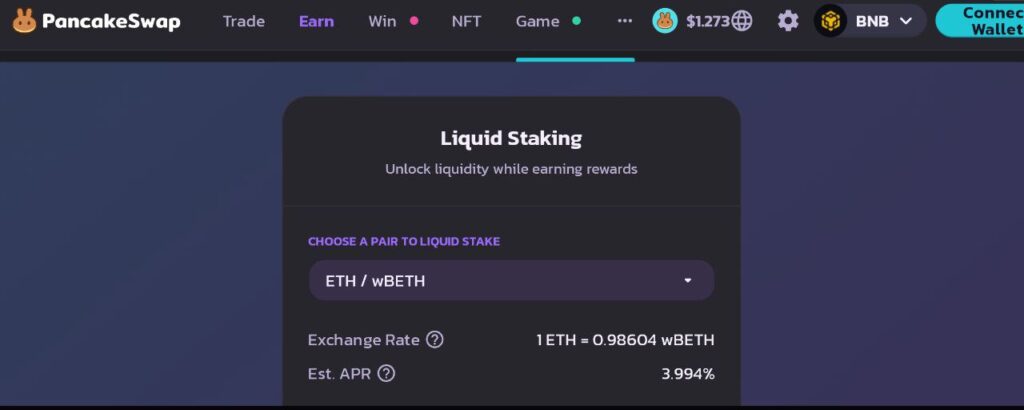

- PancakeSwap

PancakeSwap is a popular decentralized exchange allowing BEP-20 token swaps on the BNB Chain. The exchange employs an automated market maker (AMM) model, allowing users to trade against a liquidity pool. Participants can become a liquidity providers and receive LP tokens, which entitle users to a share of the exchange’s trading fees. LP token holders can also engage in yield farming to earn CAKE, the exchange’s utility token.

- Polkadot

Polkadot connects different blockchains into a single unified network. It can join networks together. The main aim of Polkadot is to act as a framework for all blockchains that opt-in. Polkadot acts as a foundation for the blockchain network. It is layer 0 blockchain on which layer 1 blockchain can be built.It uses a unique staking mechanism called ‘nomination,’ where token holders can nominate validators and earn rewards based on their nominations.

- Avalanche

Avalanche is a smart contract-capable blockchain platform that focuses on low costs and transaction speed. It is one of the fastest, open, programmable smart contracts platforms. It allows people to make transactions easier and faster. In Avalanche developers can create new blockchains and have full control over them, which allows people to set particular tokens, fees and more.By staking their AVAX tokens users can participate in the consensus mechanism of the network and earn rewards.

Related: Top 10 DeFi Protocols for Yield Farming in 2023

Conclusion

DeFi lending platforms allow users to own and control their crypto assets. It offers borderless, decentralized and open finance solutions. It is much faster than centralized institutions and does not require third-party and paperwork. DeFi represents a significant innovation in the world of finance but it has some risks and disadvantages. As blockchain technology continues to evolve, we can expect further improvement in DeFi that will lead to a more robust and decentralized financial system.

Frequently Asked Questions (FAQs)

Is Yield Farming better than Staking?

Yield Farming could be a better choice for those who want to earn high returns but it is highly risky. Staking might be good for those who want a straightforward method with low risk.

How do I start yield farming?

You can start yield farming by depositing crypto into a decentralized finance platform that promises returns.

How to make money with DeFi yield farming?

DeFi Yield farming allows users to lock their assets for a certain period of time to earn rewards for their tokens.

How does staking work?

You can stake tokens when you have cryptocurrency that uses a proof-of-stake mechanism. Staking locks up your assets to participate and helps maintain the security of that network’s blockchain. In exchange for staking crypto, validators receive staking rewards.

What are the services that DeFi platforms offer?

DeFi provides various services through various platforms such as Payments, Lending & Borrowing,Insurance, Saving and deposit, yield farming and staking.